The content is not available for Bangla language.

This 'bank for the poor' could hold the key to ending poverty and inequality

Publisshed Date: 27 November, 2016

Published By: wired.co.uk ![]()

Source: Link: http://www.wired.co.uk/article/stop-wealth-concentration-grameen-bank

The WIRED World in 2017

Nobel Peace Prize winner and founder of Grameen Bank, Muhammad Yunus, on how to stop wealth concentration

By Muhammad Yunus

Sunday 27 November 2016

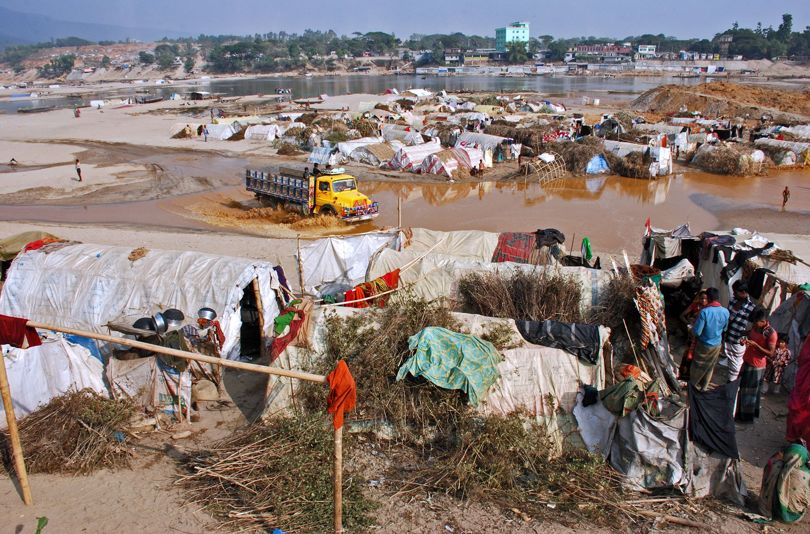

People living in tents made of polythene in Jaflong Stone Quarry, Bangladesh. One-third of the country's population lives below the poverty line. Credit: Pacific Press/Getty

In 2016, Oxfam estimated that the total wealth of 99 per cent of the global population was barely equivalent to the wealth of the top one per cent - and it would get worse each year.

Over the past few months, Bernie Sanders has made the point that, in the US, the top ten per cent owns almost as much wealth as the bottom 90 per cent.

Concentration of wealth also means concentration of power - political and social, privileges and opportunities. The reverse is also true. If you don't have any wealth, you have no power, no privileges, no opportunities. But can this inequality be tackled?

My answer is yes - but individuals must view it as a personal priority and put pressure on government to create policies that will facilitate it.

The concept of the free market relies on the notion of the so-called "invisible hand", which ensures competition and thus contributes to equilibrium in the markets. Also, that society benefits automatically if individuals pursue their own interests without paying attention to social benefits. But does the invisible hand ensure benefits equally for everybody? Obviously, the invisible hand is dedicatedly biased to the richest. That's why enormous wealth concentration continues.

We need to transform this inverted pyramid of wealth concentration into a new shape; a wealth diamond with very few at the top, very few at the bottom, and bulk of the people in the middle. The usual political agenda to reduce the problem focuses on income gap, not on wealth gap. It is done through a programme of income redistribution: taking from the top (through progressive taxes) and giving it to the bottom (through various transfer payments).

Clearly, only governments can undertake such redistribution programmes. However, in a democratic environment, a government cannot achieve success in a redistribution programme. People at the top from whom governments are supposed to collect heavy taxes are politically very powerful. They use their disproportionate influence on governments to restrain them from taking any meaningful step against their interest.

I don't think addressing income inequality is a real answer; it addresses the cause, not the manifestation. We must address the wealth gap which is the cause of the income gap. If we keep the wealth base unchanged, any reduction in income gap will be ineffective.

On top of that, governments' cash transfer programmes are usually charity programmes, which are excellent as temporary relief, but cannot give a permanent solution to the problem. Although governments should continue with their redistribution programmes, I am proposing to bring the citizen's power to transform the wealth pyramid into a wealth diamond. The central point in my proposal is to redesign the economic framework by moving from personal interest-driven economics to both personal and collective interest-driven economics.

Muhammad Yunus won the Nobel Peace Prize for founding Grameen Bank.

Credit: Vittorio Zunino Celotto / Getty

In 1983, I created Grameen Bank (GB) in Bangladesh. It wasn't like other financial institutions. Everything a conventional bank did, we did the opposite. They love to operate where businesses and rich people locate their offices. As a result, they work in cities. GB works in villages. After 30 years, GB does not have branches in any city or municipal area. Conventional banks are owned by rich people; GB is owned by the poor. Conventional banks serve mostly men; GB focuses on women. Conventional banks believe that the poor are not creditworthy. GB established for the first time in history that the poor people, more so poor women, are creditworthy in any formal banking sense. Grameen America has 18 branches in nine cities in the US with 62,000 borrowers, all of whom are women. It has given out $380m with the average startup loan being $1,000, and repayment rates are 99.9 per cent.

Conventional banks operate on the basis of collateral. GB is collateral-free. Therefore, it is lawyer-free. We have a banking system based on trust. In GB, borrowers don't come to the bank, the bank goes to borrowers. GB created a pension fund to make sure that borrowers can take care of themselves in their old age. GB offers health insurance, loans to beggars, student loans for the children of GB families, loans to build sanitary facilities. GB partially covers the funeral cost of the borrowers and loans are written off when a borrower dies. At GB, interest on a loan cannot exceed principal, no matter how long it takes to repay

My belief is that we need to build separate institutions with completely different architecture. Rich people's banks are not designed to serve the poor. They may take some token actions through NGOs, under pressure from above, but that won't constitute even a fraction of one per cent of their business. The unbanked of the world need real banking, not some "let-us-look-good" actions.

Credit should be recognised as a human right so that it can be addressed seriously and be given the importance it deserves. We can establish this only by creating a financial system for the poor.

I was amazed how easy it was to solve human problems by designing GB as a business with the sole mission of solving a problem, and with no intention to benefit financially from the business. We are always told that the business engine was designed for only one use: making money for personal use. I used the same engine for a completely different purpose: that is, to solve human problems.

I wondered why the world left the problem-solving to the governments and charities alone, and found

the answer: it was because the business world was given a very clear mandate by economic theory. Their only mandate was to make money, leaving the people's problems to be addressed by governments and charities. A businessman is supposed to be driven by self-interest. To him, business is business.

What is impossible today becomes possible tomorrow. Dramatic changes take place in technology in such quick succession that it does not surprise us anymore. It is only the power of the imagination of young people that limits the exploitation of each new technology. The bolder their imagination, the greater their accomplishments. If they start imagining a world where wealth disparity shall not exist, I can guarantee it will not exist. The combined power of youth, technology and social business can become an irresistible force.

Once we transform the education system to produce creative entrepreneurs, the picture of the wealth gap will start changing. If we leave young people with the destiny of making other people rich, wealth concentration will continue to soar. We cannot let young people become mercenaries for this system.

And we can decide to invest in social business directly or through others who are involved in it. We can earmark five per cent of our annual income and put it in a separate account, a sort of personal social business fund, to invest in social businesses.

The time is ripe for us to recognise the gravity of wealth concentration, and take actions against it. As we learn from the process of arriving at a consensus on global warming, we can initiate a similar process to build a global consensus on bringing the speed of wealth concentration to zero in phase one, and going on to make it negative in phase two.

We can undo both by reinventing ourselves as caring and sharing human beings. We may aim at creating a world of three zeros: zero poverty, zero unemployment, and zero net carbon emission. A world of diamond-shaped wealth distribution. A world of equality. It can happen if we take action in 2017.

The WIRED World in 2017 is WIRED's fifth annual trends briefing, predicting what's coming next in the worlds of technology, science and design

Related Contents

It's Time to Put Affordable Health Care for the Poor Within Reach

Author- Professor Muhammad Yunus Published on- The World Post Date- May 23, 2009 During these...

To Catch a Dollar Reveals Real Life on a Large Scale

Author- Professor Muhammad Yunus Published on- The World Post Date- March 29, 2011 I’v...

When Stretching A Dollar Means Saving A Life

Author- Professor Muhammad Yunus & Gro Brundtland Published on- The Huffington Post (US) Da...

Africa After Rio+20

Author- Professor Muhammad Yunus & Michel Camdessus Published on- The World Post Date- Jun...

A Global Conversation to Join

Author- Professor Muhammad Yunus Published on- The Huffington Post (US) Date- October 9, 2012 ...

How We Can Bring About Change

Author- Professor Muhammad Yunus Published on- The Huffington Post (US) Date- November 3, 2013...

Rohingya: Testing Democracy in Myanmar

Author- Professor Muhammad Yunus & Jose Ramos-Horta Published on- The World Post Date- Febr...

Savar Tragedy, Garments Industry and Bangladesh

Author- Professor Muhammad Yunus Published on- The World Post Date- April 9, 2013 Savar trage...

The Nation Will Not Let Grameen Bank Be Snatched Away From Poor Women

Author- Professor Muhammad Yunus Published on- The World Post Date- June 20, 2013 The recomme...

Access to Quality Education

Author- Professor Muhammad Yunus Published on- The Huffington Post Date- September 26, 2013 A...